Employee Open Enrollment for 2024 Benefits

The Summit system will be available for employees to enter open enrollment benefit elections beginning at 7 a.m. on Wednesday, Nov. 8, 2023. To enroll in, change or decline coverage, employees must make their elections by 11:59 p.m. on Wednesday, November 15, 2023.

There are many changes for 2024 insurance benefits including new medical, dental and vision vendors, new plans and added enrollment tiers. Human Resources encourages all employees to attend one in person or virtual Open Enrollment information session. Please register for a session in the County’s Learning Management System (LMS) to ensure adequate access. You can also review a presentation on 2024 Insurance Changes for Manager and Supervisors (PDF) or watch the Video.

Please thoroughly read the Employee Insurance Benefit Plan Reference Guide (PDF) and other resources provided on this page to determine which 2024 Benefit options best meet your financial and dependent needs. Questions can be emailed to [email protected] or to your department Payroll, Benefits, Transactions Assistant (PBTA).

Required - Pre-tax program re-enrollment

Pre-tax Health (FSA) and/or Dependent Care Flexible Spending Accounts require new elections annually. Participation will be waived if a new election amount for 2024 isn’t entered by 11:59pm on Wednesday, November 15, 2023. The IRS determined 2024 maximum contribution amounts are:

- Health Care $3200 - annually

- Dependent Care $5,000 - annually

- Parking $300 - monthly

Auto-enrollment if currently enrolled in Medical, Dental and pre-tax premium deductions

Pre-tax elections for medical and dental premiums will continue automatically unless waived during open enrollment. To avoid disruption, if no other plan is selected in Summit by 11:59 p.m. on Wednesday, November 15, 2023, employees and any dependents currently enrolled in the HealthPartners Distinctions medical plan will be auto enrolled in the Blue Cross Blue Shield Broad plan. Employee and any dependents currently enrolled in the HealthPartners Tiered Plan for dental will be auto enrolled in the MetLife Open Plan. Those currently enrolled in the HealthPartners Narrow Plan for dental will auto enrolled in the MetLife Select Plan.

New in 2024

Premium deductions from paychecks split between two paychecks per month

Medical premiums for all enrollment tiers will be split between two paychecks/month. All other benefit premiums will be deducted from the second paycheck of the month.

Additional enrollment tiers for medical, dental and vision insurance

Two enrollment tiers are added for 2024. Employee dependent(s) and a legally married spouse can be insured.

- Single

- Employee + Spouse - NEW

- Employee + Child(ren) - NEW

- Family (employee + spouse + child(ren))

Voluntary vision insurance – VSP Advantage Plan

This voluntary insurance provides coverage for one annual eye exam and other eye-related services and savings for prescription eyewear, lenses and contact lenses. Choose from four enrollment tiers. View a summary of the Advantage plan and the final monthly rates (PDF) paid by employees. See also VSP Vision Enrollment Benefit video

Plan documents notice

Federal guidelines require certain benefit plan documents be provided during open enrollment. To request mailed paper copies at no charge, email your department PBTA no later than Wednesday November 1st at 4 p..m to ensure arrival by November 8th.

- Premium assistance under the State’s Children’s Health Insurance Program (CHIP) - link

- Eligibility and Special Enrollment Rights

- Summary of Benefits Coverage for Preferred, Broad and High Deductible medical plans

- Employee Insurance Benefits Reference Guide

- Online Enrollment quick guide and benefits worksheet

Please note, benefit plan documents are not required to be available on this website for more than one year and may be replaced with an updated version of the document once it is uploaded to the website.

Medical Insurance - Blue Cross Blue Shield (previously HealthPartners)

View Medical Insurance Open Enrollment presentation

Preferred, Broad or High Deductible Plan

Choose the Preferred, Broad or High Deductible Plan. Choose Single, Employee + Spouse, Employee + Child(ren) or Family enrollment tier. Employee dependents and legally married spouse can be insured. Monthly premiums are decreasing for all employees depending on the plan and enrollment tier selected. View a summary of the 2024 plans and approved monthly premium rates. Refer to detailed Summary of Benefits Covered for each plan linked below or request a paper copy from your department PBTA.

Look up whether your current provider is considered in network for the Preferred, Broad and High Deductible plans. See Provider Network Access Look Up Instructions (PDF).

Look up your current prescriptions and determine the benefit level they will be for the Preferred, Broad and High Deductible plans. See Medication Benefit Level Look up Instructions (PDF)

Resources

- BCBS Member Resource Guide (PDF)

- BCBS Transition of Care Guide (PDF)

- Preventative Care Recommendations (PDF)

- Insulin Member Cost Share (PDF)

- Call Blue Cross Blue Shield customer support with questions: 1-844-348-0582, Monday-Friday, 7 a.m. to 8 p.m.

Broad Plan (Aware Network)

BCBS Summary of Benefits Covered – Broad Plan (Aware Network)

Employees and their dependents with HealthPartners coverage in 2023, will be auto enrolled in the Broad plan if no other plan is selected during open enrollment.

High Deductible Plan (Aware Network)

BCBS Summary of Benefits Covered – High Deductible Plan (Aware Network)

Employees covered by another non-Ramsey County Health plan cannot enroll in the High Deductible Plan.

Preferred Plan (High Value Network)

- BCBS Summary of Benefits Covered – Preferred Plan (High Value Network) (PDF)

- High Value Network Flyer (PDF)

- MN Care Systems in Aware and High Value Networks (PDF)

Wellness Incentive

2024

Blue Cross Blue Shield will provide up to $240 ($20/month, tax free) in electronic gift cards to each enrolled employee and spouse who participate in qualified wellness activities. Information about how to qualify and redeem earned gift cards will be available in the Blue Care Advisor portal in early January.

2023 - completing HealthPartners Healthy Benefits

There will not be a copay reduction in 2024. Employees who completed the HealthPartners Healthy Benefits program by Sept. 30, 2023 will receive $125 (taxed) on their paycheck by the end of April 2024. More information will be shared on this incentive after the first of the year.

Dental Insurance - MetLife Dental (previously HealthPartners Dental)

View Dental Open Enrollment presentation

Choose the Select or Open Plan. Choose Single, Employee + Spouse, Employee + Child(ren) or Family enrollment tier. Employee dependents and legally married spouse can be insured. Monthly premiums are decreasing for most enrollment tiers. View a summary of the 2024 plans and approved monthly premium rates (PDF). Refer to detailed Summary of Benefits Covered for each plan linked below or request a paper copy from your department PBTA.

To verify whether your current provider is considered in-network for the Select and Open plans, please go to the MetLife website and search the PDP Plus network here: https://providers.online.metlife.com/findDentist?searchType=findDentistMetLife

Select Plan

The Select plan increases the annual benefit maximum from $1,200/person to $2,000/person with similar deductibles. The Select Plan provides out of network orthodontia coverage at 50%, up to $1,000 per person.

Employees and any dependents currently enrolled in the HealthPartners Narrow Plan for dental will be auto enrolled in the MetLife Select Plan.

Open Plan (PDP Plus Network)

The Open plan provides the same deductible and coverage level for out of network dentists as in-network dentists, accommodating employees who want to continue treating with a HealthPartners dentist or other out of network dentist. The Open plan provides out of network orthodontia coverage at 50%, up to $1,000 per person.

Resources

Call MetLife Customer Support at 1-800-GET-MET8

Find a Dental Provider - PDP Plus (PDF)

Dental PPO Booklet (PDF)|

MetLife Mobile App Flyer (PDF)

Life Insurance - Minnesota Life

View Life Insurance open enrollment presentation View Lifestyle Benefits presentation

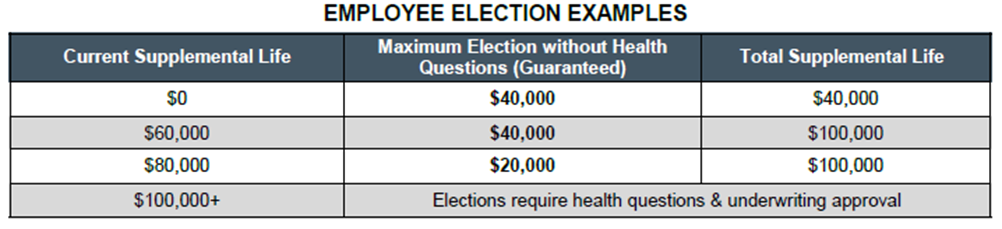

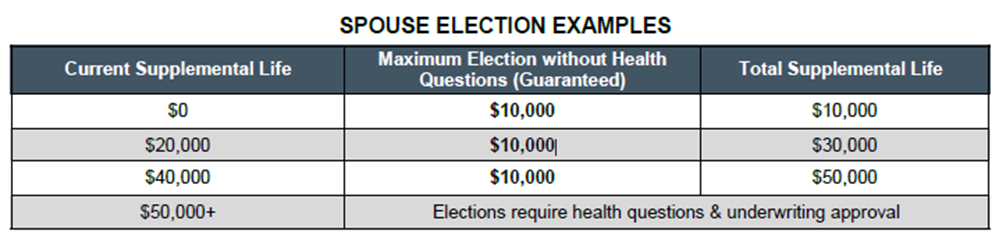

2024 rates remain the same. The optional supplemental life insurance maximum for employees will increase to $750,000 (previously $500,000) and to $500,000 (previously $250,000) for spouses. Evidence of insurability may be required. During open enrollment, there will be a one-time opportunity to elect or increase supplemental life coverage without Evidence of Insurability. Employees may elect up to $40,000 (not to exceed $100,000 when combined with current coverage) and Spouses may elect up to $10,000 (not to exceed $50,000 when combined with current coverage). See examples below. Elections must be in $1,000 increments.

Lifestyle benefits are available to all employees and their families at no additional cost including beneficiary counseling, will preparation, and travel assistance. Explore https://securian.com/ramsey-insurance.

Resources

- Why Life Insurance is Important

- Have you elected a beneficiary

- Do I need to answer health questions?

- And more!

Extra features

Minnesota Life continues to offer several attractive features as enhancements to the county’s life insurance plan. These Lifestyle benefits include, beneficiary financial counseling, will preparation, and travel assistance. They are available at no additional cost to covered employees and their families. You can read more about these features in the Employee Reference Guide on page 19.

Adjusting coverage amounts

If you are requesting additional amounts of spouse optional life insurance or optional coverage for yourself over the guaranteed issue amounts, you will need to print the Group Life Evidence of Insurability form, complete it, and fax or mail it to Minnesota Life for approval.

Disability Insurance - Madison National

Madison National Life, with National Insurance Services as the plan administrator, will continue in 2024 as the long-term disability (LTD) and short-term disability (STD) insurance provider. There will be no plan design changes in 2024 and premiums will decrease.

Extra features

Identity theft protection is available at no additional cost through Madison National. You can read more about this in your Employee Reference Guide on page 22.

Reviewing your plan

It's a good idea to review your Optional Long Term Disability and Short Term Disability election each year to see that you have adequate income protection. It's also good to review that the Short Term Disability you have selected has an appropriate elimination period based on the size of your sick leave bank.

Pre-Tax Plans - WEX (previously HealthPartners)

Pre-tax plans allow you to pay eligible Health Care and Dependent Care expenses with dollars deducted from your salary before taxes are taken out (pre-tax dollars).The maximum contribution amounts as set by the IRS for 2024 are:

- Health Care $3200 - annually

- Dependent Care $5,000 - annually

- Parking $300 - monthly

Employees who enroll in the High Deductible Health plan with a Health Saving Account are only eligible to enroll in the Limited Purpose Flex Spending Account per IRS regulations.

Carryover feature

The Ramsey County Cafeteria Plan allows for a carryover of unused Health Care FSA funds from one plan year to the next up to a maximum amount.

- Unused 2023 Health Care contributions will be carried over to 2024 up to $500. The 2023 to 2024 carryover will be administered from HealthPartners to WEX in April of 2024.

- Unused 2024 Health Care contributions will be carried over to 2025 up to $640.

Enrollment

Remember, if you want to participate or continue participation in the Pre-Tax Health Care or Dependent Care Reimbursement Programs, you must make a new election each year. Your participation in these programs will terminate if you don't make an election.

WEX Resources

Voluntary Vision Coverage with VSP (New)

Provides coverage for one annual eye exam and other eye-related services and savings for prescription eyewear, lenses and contact lenses.

Choose from four enrollment tiers and one plan, the Advantage Plan.

Contact Us

Related Resources

All documents are in PDF format.

- Employee Open Enrollment Letter

- 2024 Employee Benefit Plan Reference Guide

- 2024 monthly insurance premiums and rates

- Summary of Benefits Coverage -BCBS Preferred Plan-High Value Network

- Summary of Benefits Coverage -BCBS Broad Plan-Aware Network

- Summary of Benefits Coverage -BCBS High Deductible Health Plan-Aware Network

- Open Enrollment quick guide

- Open Enrollment Worksheet

- Department Payroll and Benefit Reps (PBTAs)

- Eligibility and Special Enrollment Rights

- Dependent drop/add form

- Medicaid and Children's Health Insurance Program (CHIP)

- 2024 Cafeteria Plan Pre-tax Benefits