2025 Budget and Tax Levy Public Hearing Information

A public hearing on the proposed 2025 supplemental county budget and tax levy was held in person on Wednesday, Dec. 11, at the Hallie Q. Brown Community Center.

Hearing summary

- Interpreters were provided in ASL, Spanish, Hmong, Karen, Oromo and Somali for in-person participants.

- Approximately 75 members of the community and 40 staff members and community partners attended the hearing.

- 17 spoken public comments were made in person.

- County Assessor staff were available in person during the hearing to address individual questions about property valuations, and received 12 requests for additional follow-up.

If you were unable to attend the public hearing you may still submit comments on the budget to the board of commissioners.

Opening remarks

County Board Char, Commissioner Victoria Reinhardt, offered opening remarks and instructions for participating in the meeting. County Manager Ling Becker then presented information about the proposed budget, with additional information provided by County Assessor, Patrick Chapman.

County Board Chair Reinhardt remarks

Good evening, everyone.

I’m Victoria Reinhardt, and I currently serve as the Chair of the Budget Committee and, as of August, the Chair of the Ramsey County Board. Normally, one person doesn’t hold both roles, but Commissioner Martinson, the previous board chair, accepted another job earlier this year. As a result, I stepped into the chair position in August.

I did not run for re-election this year, so I’ll be ending my career as Chair of the County Board, which feels like a fitting way to conclude my time here. On the county board, I represent District 7, which includes the cities of Maplewood, North St. Paul, and White Bear Lake, not the township.

On behalf of my colleagues, I want to warmly welcome you to this evening’s public hearing. We, along with the Ramsey County staff, truly appreciate you coming out tonight, especially given how cold it is. Public participation is vital, and we want to hear your feedback.

The meeting will begin with a brief presentation from County Manager Ling Becker and County Assessor Pat Chapman. Afterward, we’ll open the floor for public comments.

Before we begin, I’d like to share a few logistical notes. Water and cookies are available at the back of the room. Please help yourself if you haven’t already. Restrooms are located down the hall, near the entrance. We have interpreters available in Karen, Hmong, Somali, Spanish, and American Sign Language. If you would like interpreter assistance and haven’t already requested it, please visit the table at the back of the room.

Tonight’s meeting is being recorded and will be made available on the county’s website as part of the official public record.

Now, I’d like to take a moment to introduce my colleagues on the County Board. As I call your name, please stand so the audience can see you. I’ll also mention the district and communities you represent:

Commissioner Nicole Frethem (District 1): Represents Arden Hills, Gem Lake, Mounds View, North Oaks, Shoreview, Vadnais Heights, White Bear Township, and parts of Spring Lake Park and Blaine.

Commissioner Mary Jo McGuire (District 2): Represents Lauderdale, New Brighton, Roseville, and the Ramsey County portion of St. Anthony.

Commissioner Rena Moran (District 4): Represents St. Paul neighborhoods, including Crocus Hill, Desnoyer Park, Lexington-Hamline, Merriam Park, Snelling-Hamline, Summit Hill, St. Anthony Park, Summit-University, and parts of Hamline-Midway, Highland Park, and Macalester-Groveland.

Commissioner Rafael Ortega (District 5): Represents the St. Paul neighborhoods of Downtown, Highland Park, Macalester-Groveland, West Seventh, West Side, and Dayton’s Bluff.

Commissioner Mai Chong Xiong (District 6): Represents St. Paul neighborhoods, including Greater East Side, Payne-Phalen, Dayton’s Bluff, Conway, Highwood Hills, and surrounding areas.

Now, I invite everyone to please rise as we recite the Pledge of Allegiance.

"I pledge allegiance to the flag of the United States of America, and to the Republic for which it stands, one Nation under God, indivisible, with liberty and justice for all."

Thank you.

At this time, I would like to read the land acknowledgment:

Every community owes its existence and vitality to generations of people from around the world who contributed their hopes, dreams, and energy to building the history that led us to this moment. Some were brought here against their will, others were drawn by the hope of a better life, and some have lived on this land since time immemorial.

Truth and acknowledgment are critical to building mutual respect and connection across all barriers of heritage and difference. We are standing on the ancestral lands of the Dakota people. We want to acknowledge the Ojibwe, Ho-Chunk, and other nations of people who have also called this place home. We pay respects to their elders, past and present.

Please take a moment to consider the treaties made by tribal nations that entitle non-Native people to live and work on this traditional Native land. Consider the many legacies of violence, displacement, migration, and settlement that have brings us together here today. And please join us in uncovering and honoring such truths at any and all public events.

At this point, I would like to call up County Manager Ling Becker and she will do some of the introductions and overview of what's going to happen tonight.

Thank you.

County Manager Becker remarks

Good evening everyone. As Commissioner Reinhardt stated my name is Ling Becker. I am the County Manager for Ramsey County. I took this role on September 1 of this year, and previous to that I was the workforce director for the past six years for our organization.

I want to tell you a little bit about I want to just tell a little bit about myself as I give you some of the work that we do. I’m a first generation immigrant. My parents came here from Hong Kong when I was five years old and I find it to be an extreme privilege to be able to serve our community in this way and have had the chance to work at many of the levels of government within our community.

If we can go to the first slide here I want to just talk to you a little bit about the county level of government and about the critical services that county level government provides. In a real applicable way tonight is the first night that we have opened up our warming spaces out in the community. So, as you guys have come in and you know that it’s a very cold night one of the things that the county does is to ensure we have some evening shelters for people who do not have a warm place to sleep. So tonight is the first night we have some of those services.

In addition some of these pictures portray the county does provide the opportunity to connect residence to many of the basic assistance programs and support programs that they need in order to support their families and themselves as individuals. We provide public safety services. We also provide election services as well as recycling and waste services. We also manage a library system and have seven locations. We also operate the emergency call center for our county, including the city of St. Paul as well. We connect veterans to their benefits and we process birth records and marriage licenses.

We also maintain 290 miles of county roads and we work on things like inspecting food, establishments, and vendors as part of our public health program, as well as other things like women, infant children and other public health initiatives you might be familiar with.

As I mentioned, I was the workforce Director. We actually support all the workforce services for residence and also support our employers to have the talent that they need to be successful. And lastly, we also a couple more things we do respond to natural disasters, public health emergencies and also provide parks and recreation. So I wanted to give a little overview of some of the work that we do so.

I wanted to share a little bit about where the county gets its funding. The largest pool of funds almost 50% or 46% is from property taxes. In addition, we also get a significant portion of our funding from intergovernmental revenue so what that means is as money comes from the federal and the state government often times we're the ones responsible for doing that work. Those funds are sometimes less flexible and we’re expected to kind of use them based on the way that those programs are set up and so they are a little bit less flexible than our levy dollars.

In addition, we also have some charges for services and other miscellaneous use of money and revenue as well as we do have some funds that we used in our 25 budget for our fund balance. So, the total budget is $848 million approximately for the year. This is a top-line slide of our levy that we would like to share with you.

The county has a biennial budget. It means that we developed a budget over a two year period. So when it was originally when it was approved, it was at a 4.75% levy increase. That is also what we’re proposing as we go forth now as we get near toward the time to select a levy. The overall budget increase over the approved from the proposed is now slightly more, our budget increased slightly because we had a couple of projects that we received state funding for. One of which was a $10 million project for youth treatment homes to help young people who have behavioral and emotional challenges to have a place to stay.

Up on the other side there I can go down. We have our initial budget which was $835 million dollars. We have the proposed which has those increased funds that will be receiving and then we also have two other levees. One being the regional rail Levy, which is gonna be set at its statutory max and the housing development authority levy also set up the statutory, and that goes to support affordable housing primarily.

Alright, I'm going to turn it over to Pat.

County Assessor Chapman remarks

Thank you, Chair my name is Pat Chapman and I’m the county assessor and what I’ll talk to you today about is kind of the timeline for the way meetings happen and what the what the impacts are for some of the value changes from the 2024 valuation that your 2025 taxes will be based on.

On this slide you can see every property was valued on January 2, 2024. Those valuation notices that were mailed in March of 2024 and then those values are open to appeal at no cost to you until June 2024 when the special board of appeal and equalization meets. Then your values are set. At this time at this meeting we’re at the notice of estimated property tax mail, the only appeal you would be able to have right now is through the Minnesota tax court and although it’s called tax court, it’s about your value so if you wanted to appeal, your 2024 value for your 2025 taxes, you would have to file with the Minnesota tax court, and then next week the board will vote on budget and finalize, and then again it repeats so next March you’ll get at a tax notice of what your 2025 taxes will be.

As you can see on this slide, this is the 2023 value for taxes paid 2024. Of that 46% of our budget that Chair Becker spoke of you can see that the residential properties were approximately 55% of that tax. Although they made up almost 67% of the total value. In Minnesota residential properties typically make up more value than they're responsible for tax and that’s the way the classification system works. And you can see just one more thing I wanto to point out that side before we see like a commercial property they only make about 10% of the value almost 1, but they're responsible for about 19% of the tax so that’s one of the ways in Minnesota we try to level tax across different property types.

So let’s go to the next slide and this is tax resources. The property tax refund program from the Department of Revenue is a great great way to limit regressivity in taxation. So there are two programs there one on income and one based on tax increase with no income brackets. I would encourage everybody to go look at the revenue website, department of revenue that is on there, or call the phone numbers that’s on there. 651-296-3781. And lastly for veterans in the room if you need veterans assistance, we have the veterans county service number on here 651-266-2545 and veterans that are disabled qualify for special programs and just general veterans assistance. If you need it, you can call that number and get it.

And I will turn it back over to Chair Becker.

Questions and answers from Dec. 11 public hearing

What services (or additional services) can residents expect with the tax increase?

From 2025 Recommended Supplemental Budget by Ramsey County Manager

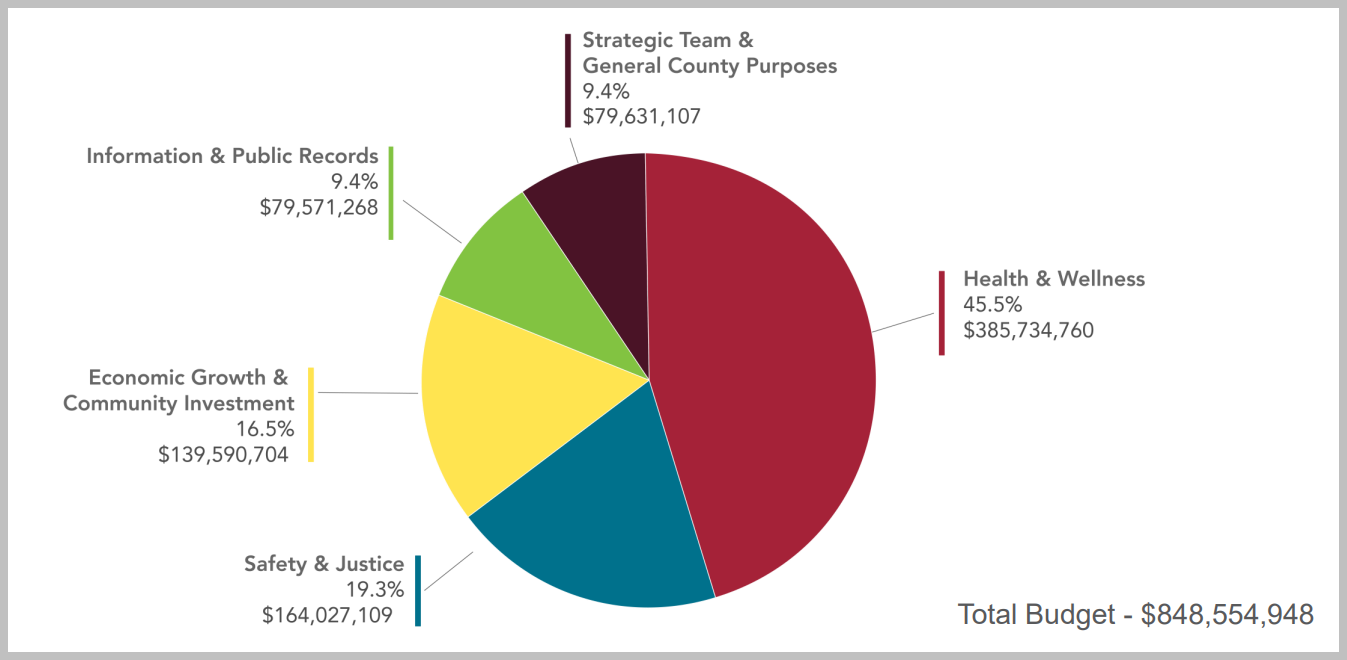

Health and Wellness (45.5%) $385,734,760, Safety & Justice (19.3%) ($164,027,109), Economic Growth & Community Investment (16.5% $139,590,704), Information & Public Records (9.4%) $79,571,268, Strategic Team & General County Purposes (9.4%) $79,631,107.

The 2025 budget builds on priorities established in the 2024-25 biennial budget, continuing investments in the individuals served by Ramsey County and the staff who deliver essential services. Key initiatives include attracting and retaining top talent to maintain exceptional service and supporting residents, businesses and visitors through targeted efforts. These investments reflect Ramsey County’s commitment to fostering trust and collaboration to create healthy, safe and thriving communities.

As in previous years, the 2025 budget emphasizes modernization to enhance client access, streamline service delivery and deepen partnerships with agencies, organizations and the community. Equity-focused initiatives such as bail reform, non-public safety traffic stops and the Appropriate Responses Initiative remain central, underscoring Ramsey County’s dedication to power sharing and the ‘Residents First’ approach.

The budget also prioritizes closing service gaps, reducing redundancies and improving accessibility for all residents. Investments focus on reimagining public spaces and leveraging technology to strengthen community connections. Ramsey County’s Service Centers in Maplewood (inside the mall), Roseville (inside the library) and Metro Square (downtown near major transit hubs) are examples of this approach. These centers offer free public Wi-Fi, computer access and navigators who connect residents to a wide range of services and resources— all in one convenient location.

Learn more about specific investments by watching each service team present its budget updates to the county board.

How are my home valuation and property taxes determined?

Property taxes for certain residential, commercial, and apartment properties may have increased or decreased due to changes in property values. When market values rise in a neighborhood or for a specific property type, such as commercial properties, the amount owed by a property can change based on its share of the tax levy. There are more than 60 property classifications, and special programs—such as the Disabled Veterans Exclusion and the Blind and Disabled Program—may also impact taxes, even for properties with similar values.

For more information, visit the Minnesota Department of Revenue's Property Tax Programs.

The valuation of your home is determined by the Ramsey County Assessor’s Office. The county assessor estimates the market value of your property by analyzing factors such as recent sales of similar properties, your home's size and condition, any improvements or renovations, and its location. This process ensures that the assessed value reflects fair market conditions.

Learn more about your property taxes and values with these informational videos:

- English - Understanding Your Property Taxes and Values

- Hmoob - Totaub Txog Cov Se Tsev thiab Lub Tsev Muaj Nqis Li Cas

- Español - Comprendiendo los Impuestos y Valores de Su Propiedad

- Soomaali - Fahamka Cashuuraha iyo Qiimaha Hantidaada Maguurtada

- Karen - Understanding Your Property Taxes and Values

If you have questions about changes in your property value, please contact the County Assessor’s Office at 651-266-2131.

What tax relief programs are available for residents?

The Minnesota Department of Revenue offers tax relief for qualifying residents age 65 or older.

Other property tax refund programs are also available for qualifying property owners. Please see the reverse of your proposed tax statement or visit the Minnesota Department of Revenue web site for details.